Hello From Pagosa Country!

I am ill. I’ve got cabin fever! We’ve had beaucoup snow this year. This is the most snow I’ve seen in several years. It reminds me of when I moved to Pagosa 40 years ago. Wolf Creek Ski Area gets an average of 400” annually. So far this year they have received 356”, and March is usually the snowiest month of the year. This is great news, because we need the moisture. We are no longer in the drought we have experienced over the last several years. Snowpack in the region is at 142% of median for this time of year.

I’m looking forward to green grass and lakes that are full. The snow is also good for our local economy. Spring Break skiers will start showing up next weekend, which means lots of Texas greenbacks coming into town. As an added bonus, it means a good rafting season this summer. I’m hoping to turn my cabin fever into spring fever, with visions of wild flowers coming very soon.

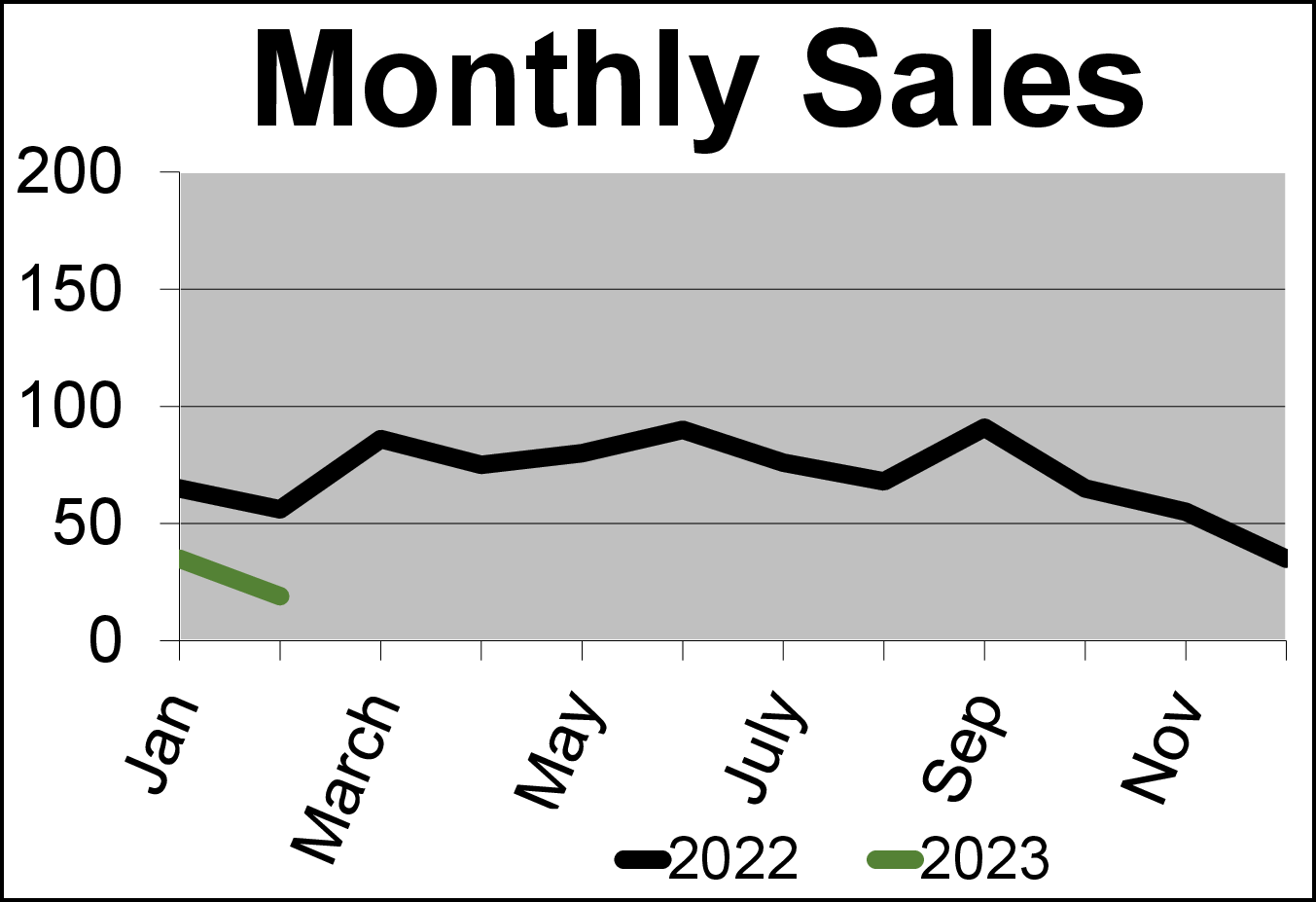

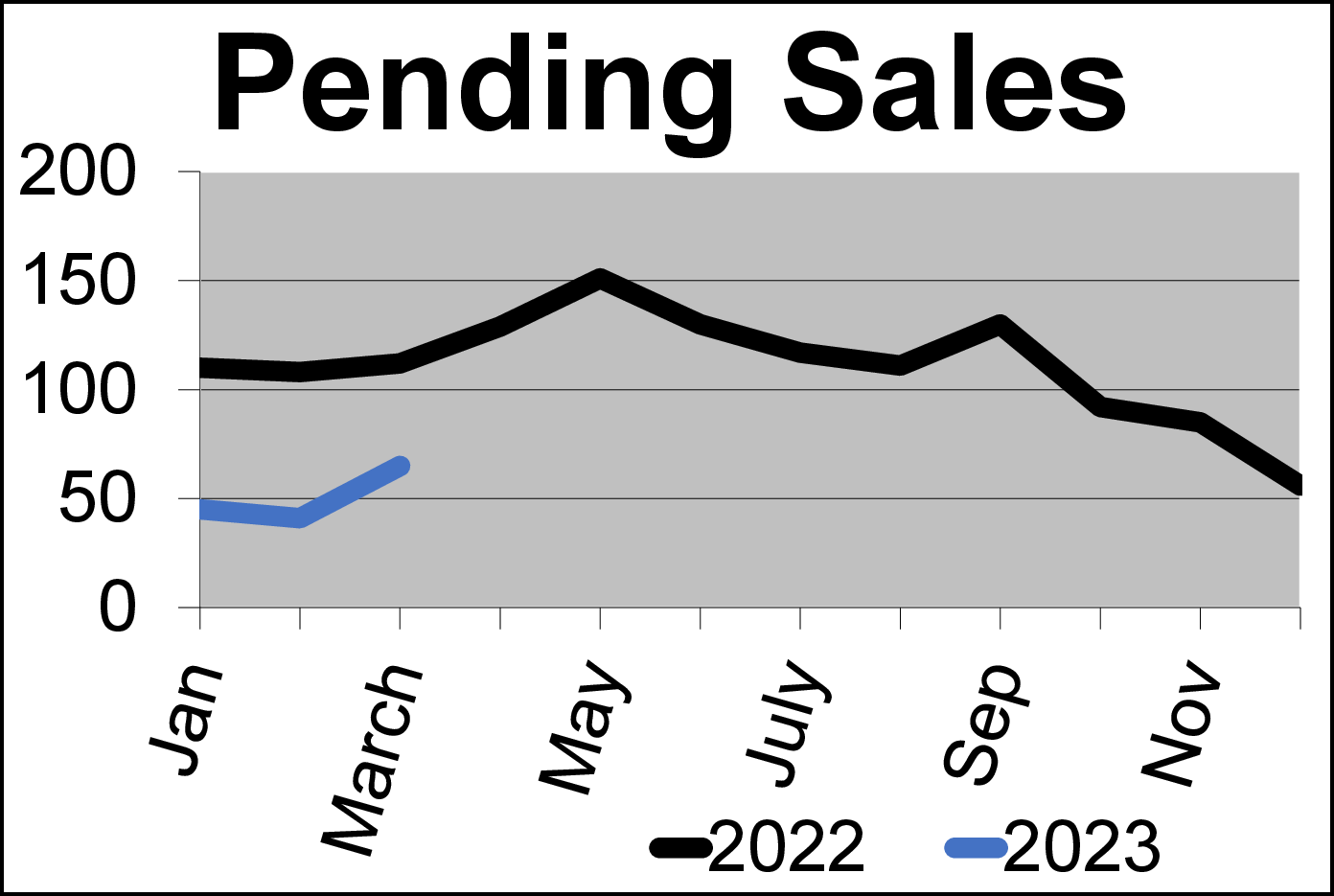

Now for the latest real estate news. As I look at the latest stats compared with this time last year, we’ve come 180 degrees. March 2022 was the peak of the market, with lots of buyers and no inventory. Multiple offers were the norm. Now, total sales year-to-date are down 57% with 54 sales today compared to 125 this time last year. Home sales are down 46%, condo sales are down 77%, and vacant land sales are down 61%. Residential inventory has doubled. A lot of the current inventory has been on the market for six months or more because it is overpriced. As new inventory comes on the market, which is priced competitively, it is selling. The last home I listed a couple weeks ago went under contract right away with two backup offers. A year ago was definitely a seller’s market. Today, it is more neutral.

One issue hurting the market is higher interest rates, which have more than doubled from 3% to 7% and rising. The Fed is trying to fight inflation, and they are expected to raise rates even further in the coming months. Keep in mind that mortgage rates are not completely tethered to the Fed rate. They can, and sometimes do, move independently. I’ve been talking to several mortgage brokers, and they are hopeful that mortgage rates may come down soon, but I’m not making any promises.

One factor that should keep prices relatively strong is our lack of inventory. We only have about a third as many homes and condos on the market as we did pre-pandemic. The other thing to keep in mind, as you study the graphs and stats below, is that this is a very small sample size, with only two months in the books. It’s a little too early for me to predict how 2023 will come out. Come June, I think we’ll have a better picture of what’s going on.

Remember to think positive – the glass is half full!

GRI, CRS

2011 & 2014 Realtor of the Year

Phone (970) 731-4065

Fax (970) 731-4068

Cell (970) 946-3856

Email: [email protected]